22+ what is dscr mortgage

Web Debt service coverage ratio DSCR is a measure of a business or commercial propertys cash flows versus its debt obligations DSCR is calculated by dividing the companys annual net operating income by its annual debt service including principal interest and lease payments. This will also allow you to save your DSCR results for future reference.

Understanding Commercial Real Estate Loan Covenants During The Pandemic Realogic

Web What is a debt service coverage ratio.

. In contrast to private purchases commercial mortgages are taken with one main objective. No Strict Income Verification Requirement 2. Web What does the debt service coverage ratio mean when it comes to real estate.

Web DSCR stands for debt service coverage ratio. Web DSCR is the inverse of DTI Debt to Income ratio that underwriters use to evaluate a borrowers capacity to handle mortgage debt. Web A DSCR is a measurement tool that determines whether the chosen investment will produce enough income to cover the suggested debt obligation.

DSCR Calculator Run unlimited DSCR calculations using the same formula used by all major residential lenders for free. Whereas traditional mortgage lenders review your income to determine your eligibility DSCR lenders instead look at the investment propertys cash flow. Web The Debt Service Coverage Ratio DSC is one metric within the coverage bucket when analyzing a company.

The latter includes principal interest property taxes insurance and any homeowners or condo association fees abbreviated. It is a way of determining whether a borrower has enough cash flow to pay its current debt obligations. DSCR Loan Down Payment.

Web DSCR Formula for Real Estate For commercial real estate the debt service coverage ratio DSCR definition is net operating income divided by total debt service. DSCR loans are unique in that they are based on the amount of cash flow a business generates each month compared to the amount of debt service payments the business. Web DSCR mortgage loans also known as debt-service coverage ratio mortgages is a type of non-QM loan for real estate investors of investment and rental properties.

Web A DSCR loan is a mortgage product that caters to real estate investors. No Refinancing Risk 5. Flexible mortgage options allow self-employed real estate investors and jumbo borrowers to finance real estate.

Web The Loan Tree Debt Service Coverage Ratio Mortgage or DSCR is a No-Income Verification Mortgage. Web A Debt-Service Coverage Ratio DSCR loan is a top option for borrowers who want to use investment earnings rather than their personal income to qualify for a mortgage. Unlimited Number of Loans Are There Any Disadvantages of Taking Out a DSCR Mortgage.

As a real estate investor you can avoid high rates and high points of private fix flip loans a lengthy approval processes and strict lending criteria. Web Run unlimited DSCR calculations using the same DSCR calculator that mortgage lenders and underwriters use to calculate debt service coverage ratio. A DSCR of 10 or above is known as a breakeven point and means that the property.

Qualify for an investment property purchase or refinance loan without using your tax returns. Web How to Calculate DSCR for Residential Rental Properties. It is calculated by dividing the net operating income NOI by the total loan payments per year.

Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property as well as to determine how much income coverage there will be at a specific. The ratio can be used to assess whether a company will be able to use income to. Competitive Loan Products 3.

Some of the highlights of this loan program include. Very Simple and Quick Loan Process 4. The number generated is known as the debt service coverage ratio or DSCR.

It is a metric commonly used in commercial lending instead of personal credit scoring to establish whether the borrowers investment makes sense from an economic point of view. For residential rental properties with 1-4 units lenders typically calculate the DSCR by simply dividing the monthly rent by the monthly mortgage payment. It is a type of mortgage that allows you to qualify for an investment property based on the prospective monthly rental income that is calculated for that home.

Web The Debt Service Coverage Ratio is a ratio of a propertys annual net operating income and its annual mortgage debt including principal and interest. Web What Are the Benefits of Taking Out a DSCR Loan 1. The debt service coverage ratio DSCR is the ratio of an investments net operating income to its total debt service.

Web DSCR stands for Debt-Service Coverage Ratio. The higher the DSCR the more cash flow there is available to make payments on the loan and it is thus preferred by lenders. Web A Debt-Service Coverage Ratio DSCR loan is a specific type of loan that businesses can use to finance the purchase of multifamily and commercial real estate.

DSCR is a measure of the borrowers capacity to service or repay their yearly debt payment in relation to their total net operating income NOI. All non-QM loan programs were halted after the coronavirus outbreak pandemic hit the nation in February 2020. Therefore the lender will calculate DSCR to determine whether to grant a loan to the real estate developer.

Web The real estate developer discloses that it has an operating income of 200000 per year and has to pay a yearly interest of 70000 on the loan he had taken. No income or employment required Can close in the name of a LLC. Web A DSCR loan short for debt service coverage loan is a mortgage available to individuals to help them purchase investment properties.

It features a streamlined approval process that doesnt involve traditional income verification. Web The debt service coverage ratio DSCR for commercial loans is a measure of an entitys ability to meet its debt obligations. Other coverage ratios include EBIT over Interest or something similar often called Times Interest Earned as well as the Fixed Charge Coverage Ratio often abbreviated to FCC.

With DSCR you take the income from an investment property and divide it by the. For example suppose Net Operating Income NOI is 120000 per year and total debt service is 100000 per year. DSCR 200000 70000.

This type of loan falls under the Non-QM umbrella meaning that it doesnt require borrowers to meet the strict federal guidelines mandated by traditional mortgages. Web DSCR is a commonly used financial ratio that compares a companys operating income to the companys debt payments.

Debt Service Coverage Ratio Dscr Multifamily Loans

8 Frequently Asked Questions About Dscr Loans May 2022 Youtube

What Is A Dscr Loan Your Everything Guide To Getting Started

Investor Cash Flow Loan Martini Mortgage Group

Dscr Debt Service Coverage Ratio Commercial Real Estate Loans

Dscr Loan 2023 The No Tax Return Mortgage My Perfect Mortgage

Rental Income Mortgage Mbanc Com

:max_bytes(150000):strip_icc()/GettyImages-1353423255-dbf0ac39dd5d4ef4aed1471b2d109b85.jpg)

What Is Debt Service Coverage Ratio Dscr

:max_bytes(150000):strip_icc()/Debt-service-coverage-ratio-294523bd49304cefabe7af0ad69a28f4.jpg)

Debt Service Coverage Ratio Dscr How To Use And Calculate It

Dscr Loan 2023 The No Tax Return Mortgage My Perfect Mortgage

Uncss91jlghcqm

Calculating The Debt Service Coverage Ratio And Why It Matters Commercial Property Executive

Shevon Valentine Mortgage Broker Nexa Mortgage Linkedin

Rental Income Mortgage Mbanc Com

Debt Service Coverage Ratio Dscr Loans

Loan Life Cover Ratio A First Principles Explanation Operis

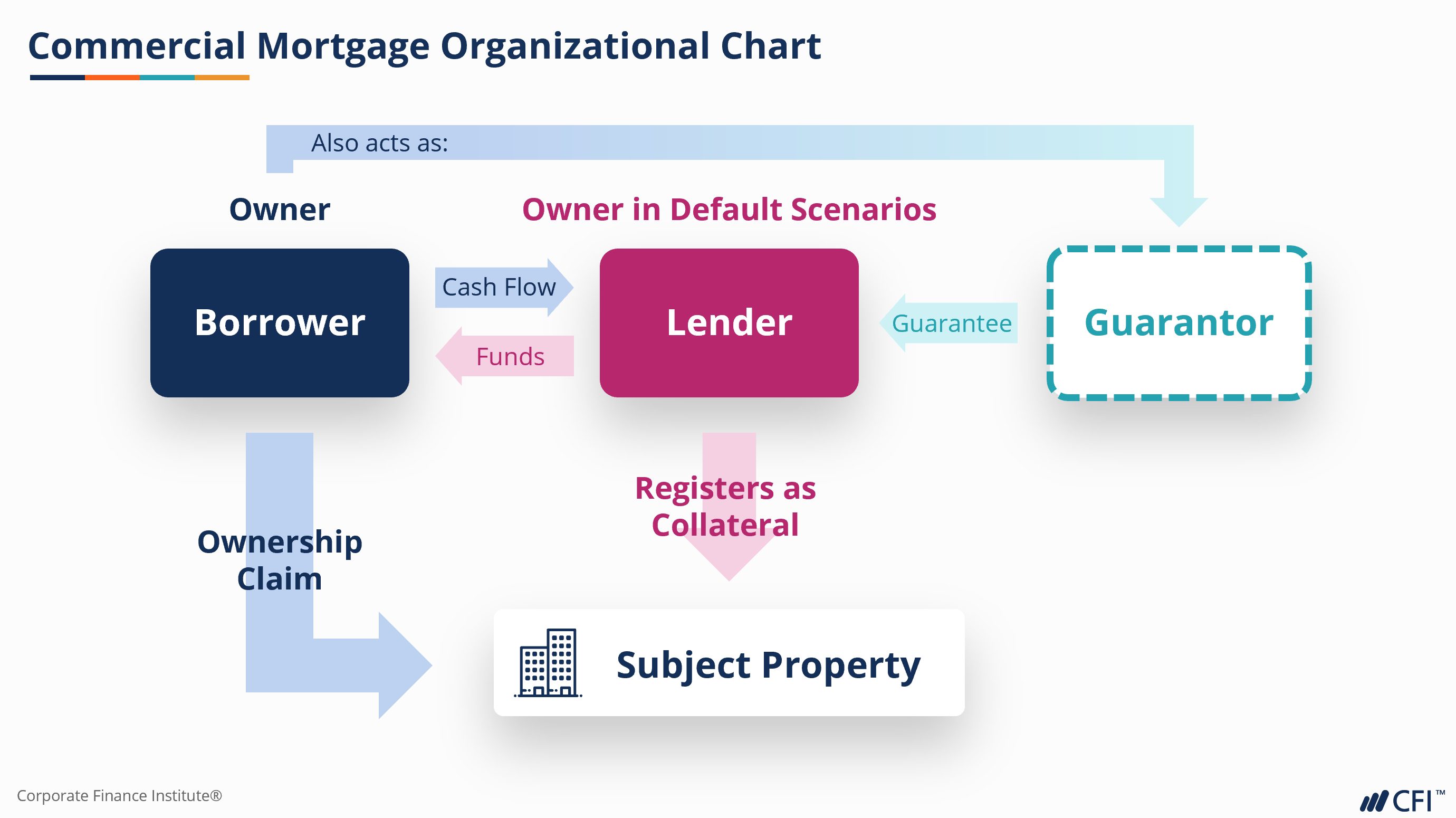

Commercial Mortgages I Finance Course I Cfi